Have you ever felt like you were tied down to a bank account that just wasn’t working for you anymore? Maybe the fees are too high, the customer service is subpar, or your financial needs have simply changed. Whatever the reason, closing a bank account can feel like a daunting task, especially when you’re unsure about the process. But fear not! This article will guide you through the intricacies of closing your bank account, complete with a sample letter to help you navigate this often-overlooked process.

Image: www.aiophotoz.com

A bank account closing letter may seem like a minor detail in the grand scheme of things, but it’s crucial for ensuring a smooth transition and avoiding any potential complications down the line. This letter serves as a formal notice to your bank, outlining your request to close the account and providing them with the necessary information to process it efficiently. Let’s dive into the importance of this letter and how you can write one that gets the job done.

Why Write a Letter When You Can Just Call?

In our fast-paced digital world, a written letter might seem like an archaic relic of the past. But in this instance, a well-crafted letter holds several advantages that can make your bank account closing process more secure and efficient.

1. A Clear Record for You and the Bank

A written letter acts as a formal record of your request. It provides clear documentation of the date you initiated the closing process, the specifics of your request, and any additional information you may wish to provide. This written record can be invaluable if you encounter any issues or disputes later on.

2. Ensuring Accurate Communication

Let’s be honest, sometimes phone calls can be muddled by background noise, connection issues, or even misunderstandings. A written letter eliminates these obstacles by providing a clear and concise message that eliminates the potential for miscommunication. No more playing telephone with your bank!

Image: www.uslegalforms.com

3. A Professional Touch

A well-written letter demonstrates your professionalism and seriousness about closing your account. It also gives you an opportunity to express any concerns or feedback you might have about your banking experience. Remember, a sincere and respectful tone goes a long way in any communication, even with your bank.

Crafting Your Bank Account Closing Letter

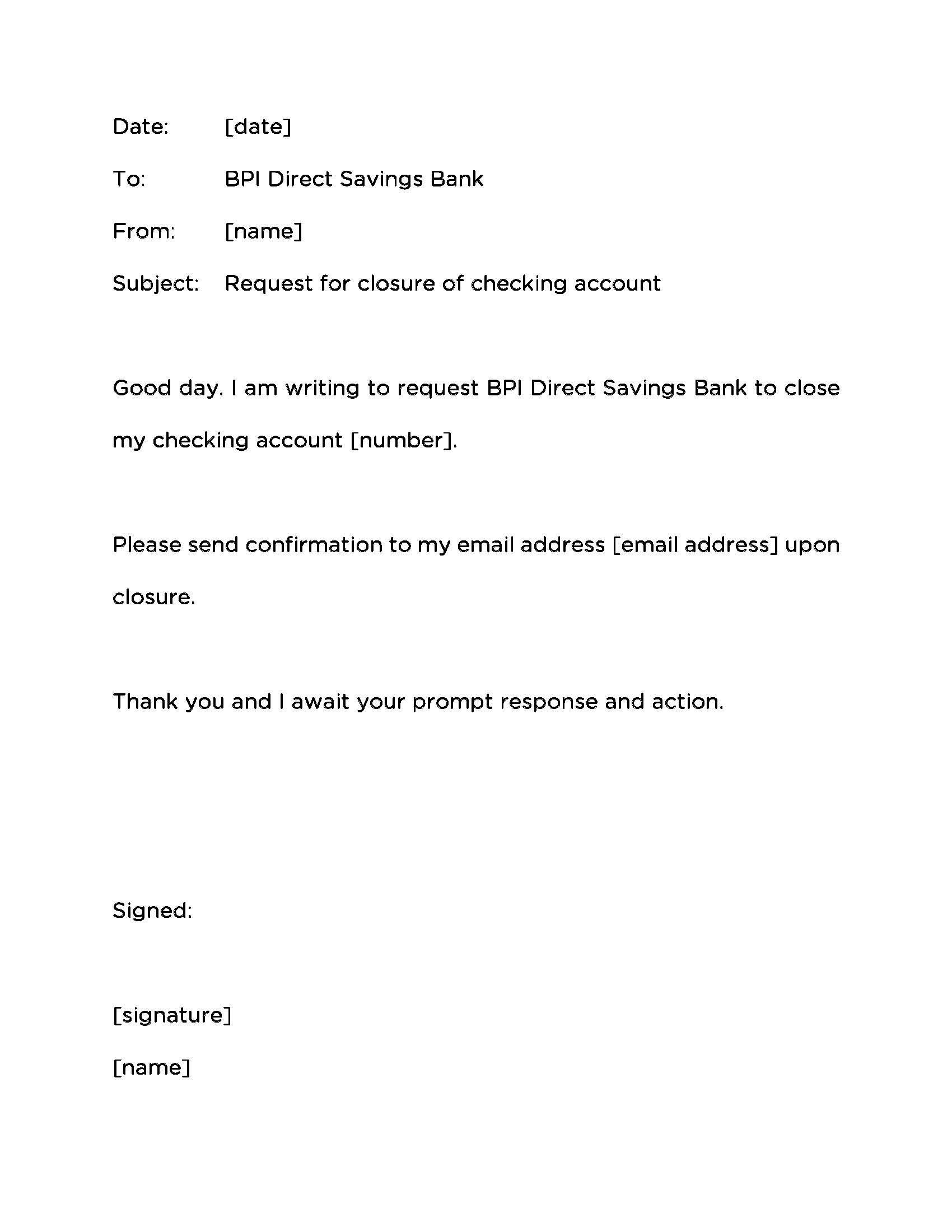

Now, let’s get to the heart of it—creating the perfect bank account closing letter. Here’s a sample letter you can adapt to your own specific situation:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Bank Name]

[Bank Address]

Subject: Request to Close Account [Account Number]

Dear [Bank Representative],

This letter serves as a formal request to close my account [account type] at your bank, Account Number [account number]. Please process this closure as soon as possible, and confirm receipt of this letter by [date].

I kindly request that you [specify any specific instructions, such as transferring funds to another account, closing the account and sending a check, etc.].

Please confirm the closure of this account by [date], and send all necessary documentation to the address listed above.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

Important Considerations When Closing Your Account

Remember that your journey to closing your bank account doesn’t end with writing a letter. Here are a couple of crucial things you need to consider before sealing the deal:

1. Outstanding Balances and Fees

Make sure you have addressed any outstanding balances or fees associated with your account. It’s essential to pay off any debts or resolve any outstanding charges to avoid any future complications. Also, verify if there are any early account closure fees that may apply.

2. Direct Debits and Standing Orders

Don’t forget about any automatic payments, direct debits, or standing orders linked to your account. You’ll need to update these with new payment information or cancel them entirely. This is crucial, as neglecting this step could lead to missed payments or even bounced checks.

3. Safeguarding Your Money

If you’re closing an account with a remaining balance, you need to decide how you want the funds to be handled. Do you want the money transferred to another account, sent to you as a check, or transferred to a different financial institution? Make sure your closing letter details your preferred method of receiving these funds.

4. Understanding the Bank’s Procedures

Familiarize yourself with your bank’s procedures regarding account closures. Some banks might require you to visit a branch in person to complete the process. It’s best to reach out to your bank directly to understand their specific requirements and ensure a smooth closure.

Making the Most of Your Closing Experience

Closing a bank account doesn’t have to be a stressful experience. By following these steps and writing a well-structured letter, you can ensure a smooth transition and take control over your finances.

1. Keep it Simple and Clear

Keep your letter concise and to the point. Use clear and professional language to avoid confusion and misunderstandings. Remember, clarity is key to successful communication.

2. Double-Check Your Details

Before sending your letter, proofread it carefully. Double-check all account numbers, addresses, and other crucial information to ensure accuracy. Don’t let a simple typo become a roadblock in your closing process.

3. Keep a Copy for Your Records

Always keep a copy of your letter, along with any other relevant documentation, for your records. This document will serve as proof of your request and will be helpful for any future reference.

4. Be Patient and Follow Up

After sending your letter, be patient and allow your bank adequate time to process your request. If you haven’t received confirmation of the account closure within a reasonable timeframe, feel free to follow up with your bank to inquire about the status of your request.

Your Next Chapter: Choosing the Right Bank for You

Now that you’ve bid farewell to your old bank account, it’s time to look ahead. Take this opportunity to explore the vast world of banking options and find a bank that truly aligns with your needs and financial goals.

1. Compare Different Banks and Services

Research different banks, comparing their fees, interest rates, and available services. Consider factors like mobile banking accessibility, customer service reputation, and any special features that might be important to you.

2. Don’t Hesitate to Ask Questions

Don’t be afraid to reach out to different banks to ask questions about their products and services. A bank that’s truly invested in your well-being will be more than willing to address your concerns and help you find the right solution for your financial needs.

3. Focus on Your Financial Goals

Remember, choosing the right bank is about more than just finding a place to store your money. It’s about finding a partner in your financial journey, a bank that helps you achieve your financial goals, whether it’s saving for retirement, buying a home, or building your business.

Bank Account Closing Letter Sample Pdf

Final Thoughts: A Bank Account is a Partnership

Closing a bank account is a process, not just a single event. Remember, your relationship with your bank is a partnership. Open communication, clear expectations, and honest documentation are crucial for ensuring that this partnership is mutually beneficial.

The sample letter provided in this article is a starting point. Feel free to customize it to fit your specific situation and to reflect your individual voice. As you embark on your financial journey, remember that you have the power to choose the banks and financial products that will serve you best. Happy banking!