Have you ever felt a pang of anxiety thinking about the potential collapse of the stock market? Or experienced a surge of fear realizing the value of your savings could vanish overnight? These uncomfortable feelings aren’t uncommon in today’s volatile financial landscape. You might not know it, but these anxieties speak to a phenomenon that some financial experts refer to as “death cards” – moments of immense financial instability that can cripple individuals and economies alike.

Image: bare.com.au

This intriguing term, however, is not a casual metaphor. It speaks to the very real and devastating impact of financial crises, events that have the power to extinguish careers, dismantle businesses, and shatter lives. This article explores the concept of “death cards,” dissecting the factors that trigger them, their historical impact, and most importantly, the strategies individuals can employ to navigate these turbulent waters.

Understanding the “Death Cards” Phenomenon

The term “death cards” refers to events that trigger widespread financial devastation, often leaving lasting scars on individuals and economies. These events can range from stock market crashes to global recessions, currency devaluations, and even natural disasters with far-reaching financial consequences. While the causes of each “death card” may differ, they all share a common thread: a sudden and dramatic loss of value in assets, resulting in widespread financial instability.

Imagine, for instance, a sudden collapse of the housing market, rendering homes worthless and jeopardizing millions of mortgage holders. Or picture a global pandemic that throws economies into chaos, leading to widespread job losses and business closures. These scenarios, which are not mere hypotheticals but historical realities, represent the brutal consequences of “death cards.” They underscore the fragility of financial systems and the vulnerability of individuals to economic shocks.

Reconsidering History: The Rise and Fall of Empires

Throughout history, countless civilizations have risen and fallen, often due to economic factors. The collapse of the Roman Empire, for instance, is partly attributed to its unsustainable economic policies and rampant inflation, forcing many citizens into poverty. The Dutch Golden Age, a period of unprecedented economic prosperity in the 17th century, also met a dramatic end due to a combination of factors, including war, trade disruptions, and speculative bubbles – all events that can be considered “death cards” of their time.

It’s not just ancient civilizations that have experienced the devastating impact of “death cards.” The Great Depression of the 1930s, triggered by the infamous Wall Street crash of 1929, stands as a stark reminder of the profound consequences of financial crises. It plunged the world into a period of immense economic hardship, characterized by mass unemployment, poverty, and societal unrest.

Similarly, the Asian financial crisis of 1997-1998, which began in Thailand and spread across the region, highlights the interconnectedness of global economies and the potential for domino effects when crisis strikes. This event exposed the vulnerabilities of emerging markets and showcased how financial instability in one corner of the world can quickly resonate across the globe.

The Modern Era and the Rise of the “Death Cards”

The financial landscape in the 21st century is characterized by globalization, technological advancements, and complex financial instruments that have both amplified the potential for financial instability and presented new avenues for “death cards.”

In 2008, the world experienced a global financial crisis, the worst since the Great Depression, triggered by the collapse of the US housing market and the subsequent failure of major financial institutions. This crisis, often referred to as the “Great Recession,” demonstrated the domino effect of financial instability, as it spread across continents, affecting economies and individuals alike.

The emergence of new technologies, while bringing immense benefits, has also created new avenues for financial vulnerability. Cryptocurrency markets, for example, have experienced dramatic volatility, demonstrating the fragility of decentralized systems in the face of market fluctuations.

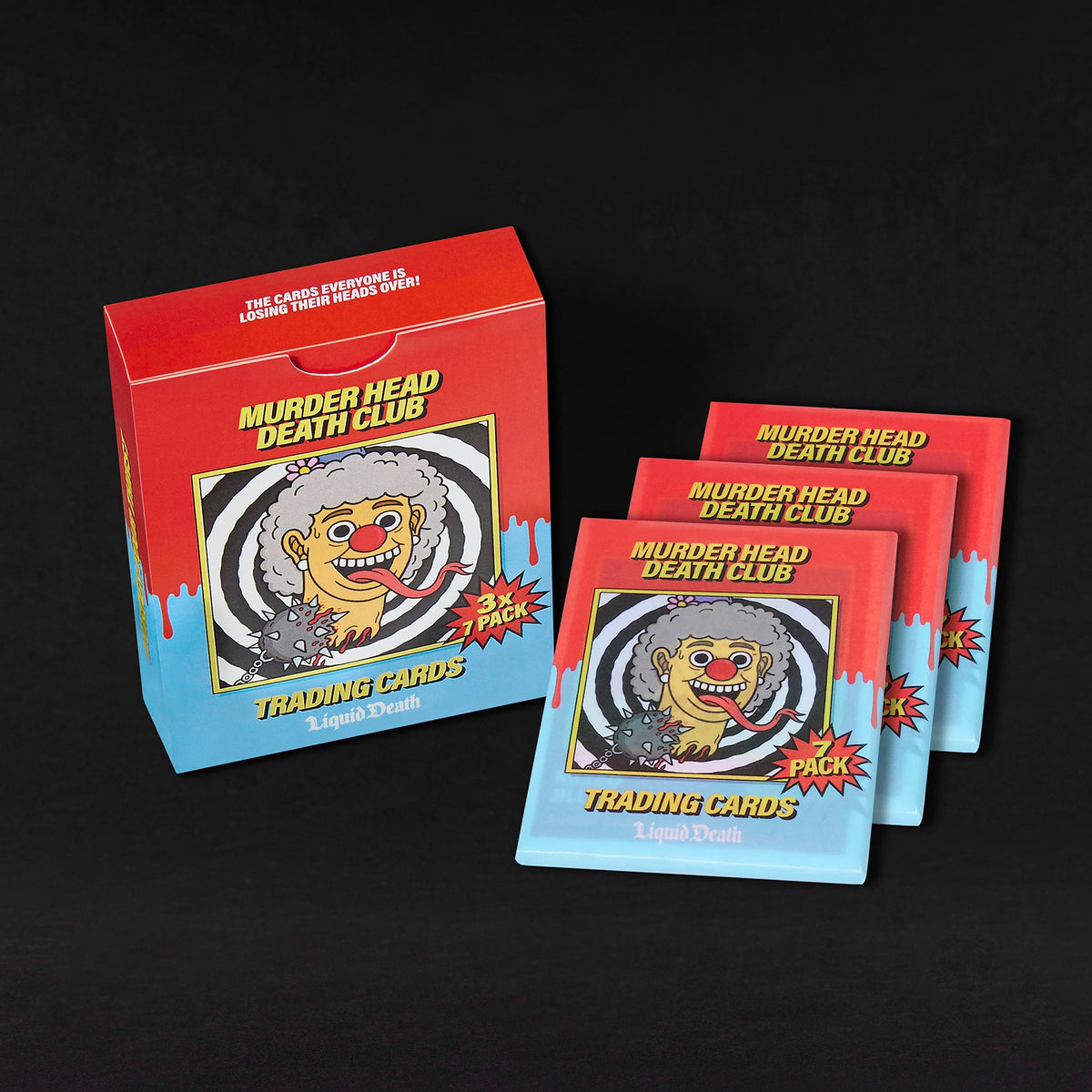

Image: liquiddeath.com

Understanding the Threat and Navigating the Waters

Understanding the potential for “death card” events is crucial for individuals and economies alike. These events are not just theoretical possibilities but real threats to our financial stability. They highlight the need for prudent financial planning and a diversified investment approach.

To navigate these volatile waters, individuals can adopt strategies that minimize their vulnerability to financial shocks. This includes:

- Building an emergency fund: A substantial emergency fund acts as a buffer against unexpected financial challenges, providing a cushion during crises.

- Reducing debt: High debt levels can increase financial vulnerability. Reducing debt can enable individuals to navigate turbulent waters with greater financial flexibility.

- Diversifying investments: Spreading your investments across various assets can help mitigate the impact of any single market downturn.

- Staying informed about financial markets and global trends: Being aware of economic indicators and potential risks can empower individuals to make informed financial decisions.

Some Financial Experts Call What Death Cards

Empowering Yourself in Uncertain Times

While financial crises can be disruptive and frightening, they also present opportunities for growth and resilience. By understanding the potential for “death cards,” adopting prudent financial strategies, and staying informed about global economic trends, individuals can navigate these challenging times with greater confidence. Remember, preparing for financial instability is not about surrendering to fear but about empowering yourself to overcome adversity and build a stronger financial future.