Have you ever wondered how businesses keep track of their money? It’s not just about counting cash at the end of the day. There’s a whole system of recording financial transactions that ensures accuracy and transparency, and it all starts with a crucial process called journalizing. This chapter dives into the world of journalizing transactions, uncovering its power, purpose, and how it forms the foundation of financial accounting.

Image: www.coursehero.com

Whether you’re a budding entrepreneur, a curious student, or simply someone interested in understanding how businesses operate, grasping the concept of journalizing is essential. It’s the first step in the accounting cycle, a set of procedures used to record, analyze, and summarize financial information. This chapter provides a comprehensive guide to help you navigate this fundamental accounting concept, demystifying its intricacies and equipping you with the knowledge to confidently analyze and interpret financial records.

Understanding the Essence of Journalizing

A Glimpse into the Accounting Cycle

Think of the accounting cycle as a streamlined process that helps businesses keep their financial records in order. It’s like a well-organized filing system for every financial transaction, ensuring that every penny is accounted for. The cycle begins with *journalizing*, which means recording every transaction in a chronological order, giving you a clear and detailed picture of your business’s financial activity.

Unveiling the Power of the Journal

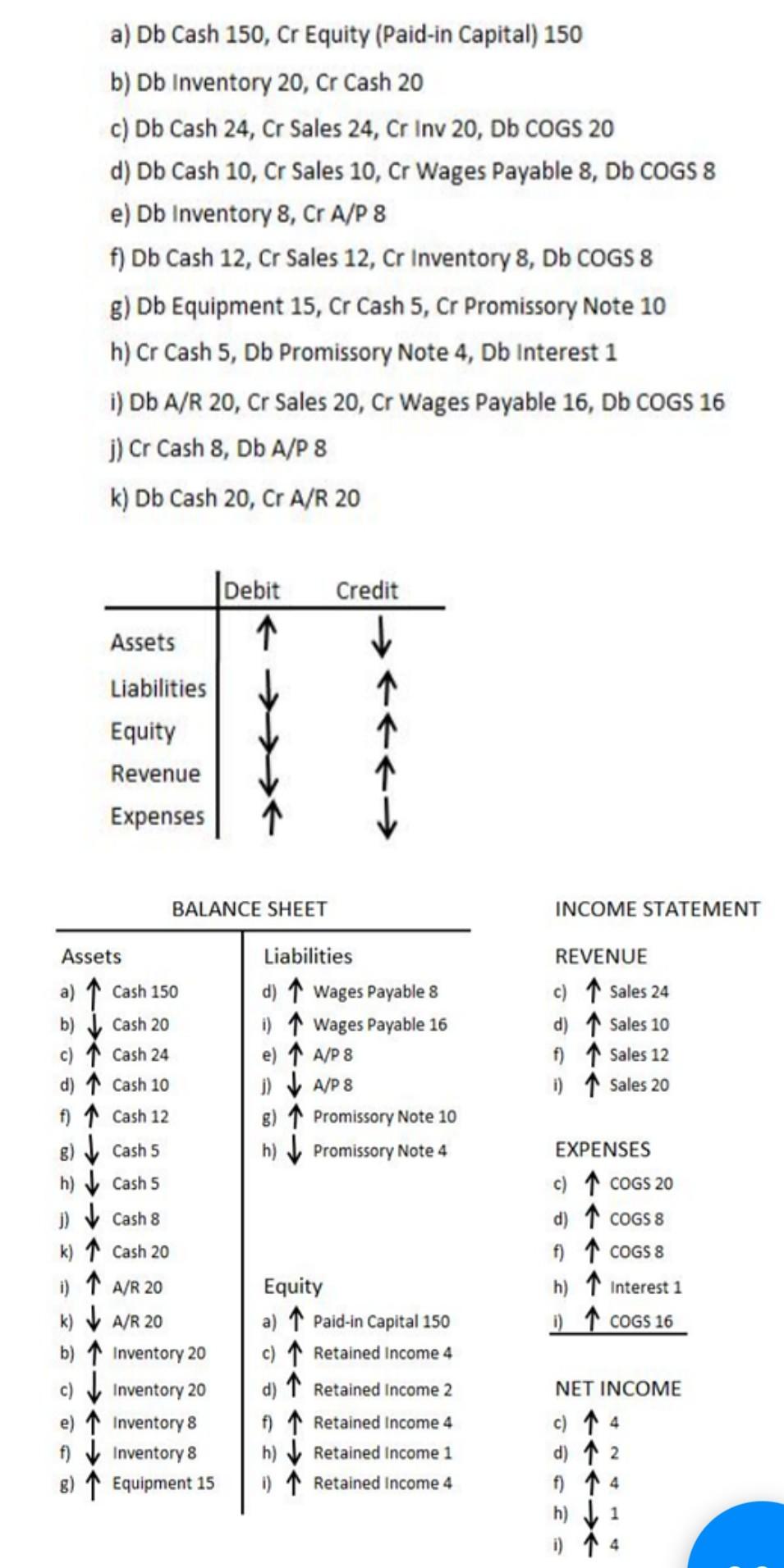

The heart of the journalizing process lies within a special accounting record called the *journal*. It’s like a diary for your business’s financial life, capturing the who, what, when, and how of every transaction. Each entry in the journal is a *journal entry*, a concise record showcasing the accounts affected by the transaction and their corresponding debits and credits.

Image: www.chegg.com

Debits and Credits: The Currency of Accounting

The language of accounting revolves around *debits* and *credits*. While the terms might sound daunting, they’re simply ways to categorize transactions. Think of debits as increases in assets or decreases in liabilities and equity. Credits, on the other hand, represent decreases in assets or increases in liabilities and equity. The key is to remember that *every transaction must have an equal debit and credit entry.*

A Real-World Example: The Power of Illustration

Let’s say a business purchases supplies for $100 by paying cash. Here’s how this transaction would be journalized:

- Date: [Today’s Date]

- Account: Supplies

- Debit: $100

- Account: Cash

- Credit: $100

- Explanation: Purchase of supplies for cash.

This journal entry clearly shows that the supplies account is increased (debited) by $100, while the cash account is decreased (credited) by $100. This ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced, a fundamental principle of accounting.

Types of Journal Entries: Navigating the Financial Landscape

There are various types of journal entries, each tailored to record specific types of financial transactions. Understanding these types will help you grasp the different facets of financial accounting and gain a deeper understanding of how businesses manage their finances:

1. Sales Journal: Capturing Revenue

This journal is specifically dedicated to recording sales transactions, reflecting the revenue generated by a business. Every time a sale is made, the sales journal captures the date, customer information, the amount of the sale, and the corresponding credit to the accounts receivable account (if the customer is paying later) or cash account (if the payment is immediate).

2. Purchases Journal: Tracking Expenses

The purchases journal focuses on the acquisition of goods or services that are essential for the business’s operations. Each entry records the date, supplier information, the amount of the purchase, and the debit to the purchases account (for the cost of goods) and the credit to accounts payable (if payment is due later) or cash account (for immediate payment).

3. Cash Receipts Journal: Monitoring Inflows

This journal acts as a centralized record of all cash received by the business. Every time money flows into the business, regardless of the source, the cash receipts journal diligently records the date, source of the cash, the amount, and the corresponding debit to the cash account and the credit to the relevant revenue or liability accounts.

4. Cash Disbursements Journal: Keeping Tabs on Outflows

In contrast to the cash receipts journal, the cash disbursements journal focuses on tracking all cash payments made by the business. It meticulously records the date, purpose of the payment, the amount, and the corresponding credit to the cash account and the debit to relevant expense or asset accounts.

5. General Journal: A Versatile Recording Tool

The general journal serves as a catch-all for transactions that don’t fit neatly into the specialized journals. It records a diverse range of transactions like adjustments to accounts, corrections of errors, and other miscellaneous entries that don’t fall under the scope of the other journals.

Journalizing Techniques: Building a Solid Foundation

Journalizing isn’t just about making entries; it’s about doing it correctly based on the specific accounting rules and principles. Mastery of journalizing techniques ensures accuracy and prevents errors that can lead to misleading financial reports.

Stepping Through the Process

Here’s a step-by-step guide to journalizing transactions:

- Identify the accounts: Determining which accounts are affected by the transaction is the first step. This involves understanding the nature of the transaction and its impact on the business’s financial position.

- Determine the debit and credit: Once you’ve identified the accounts, determine whether they increase or decrease as a result of the transaction. This will help you decide whether to debit or credit each account.

- Record the transaction: After you identify the accounts and their corresponding debits and credits, you can formally record the transaction in the appropriate journal.

- Balance the equation: Every journal entry must have equal debits and credits to ensure the accounting equation is balanced.

- Provide a clear explanation: A brief explanation of the transaction is essential for clarity and auditing purposes.

The Significance of Journalizing: More than Just Record-Keeping

While journalizing is a fundamental aspect of accounting, its importance extends beyond just meticulously recording financial transactions. It plays a critical role in ensuring accuracy, providing a trail for audits, and supporting decision-making within a business.

Accuracy as a Cornerstone

Journalizing forms the basis for all subsequent accounting records. Accurate journal entries are essential for producing reliable financial statements, which are crucial for making informed decisions about the business’s future. Errors in journal entries can cascade through the accounting system, resulting in inaccurate financial reports. Therefore, accuracy is paramount to the integrity of financial data.

Auditing Trail: Illuminating the Path

Journal entries act as a detailed and chronological record of financial activities. This creates a clear audit trail, enabling auditors to trace transactions and verify their accuracy. The presence of well-organized and accurate journal entries is crucial for demonstrating financial transparency and accountability.

Support for Decision-Making: Illuminating Insights

Journalizing not only provides a snapshot of past financial activity but also serves as a valuable tool for decision-making. By analyzing the patterns and trends observed in journal entries, businesses can gain insights into their financial performance, identify areas for improvement, and develop strategies for future growth.

The Future of Journalizing: Embracing Technology

The accounting world is steadily embracing technology, and journalizing is no exception. Software solutions are revolutionizing the way businesses manage their financial records, automating processes, and enhancing efficiency.

Automation: Streamlining the Process

Accounting software simplifies the journalizing process, allowing businesses to enter transactions directly into the system, automatically generating journal entries. These software solutions provide features like error checking to ensure accuracy and facilitate financial reporting that is more comprehensive and user-friendly.

Cloud-Based Accounting: A New Era

Cloud-based accounting software is gaining widespread popularity. This allows businesses to access their accounting information from anywhere with an internet connection, enhancing flexibility and collaboration. These systems are continuously evolving, incorporating innovative features that further simplify journalizing and improve efficiency.

Chapter 3 Journalizing Transactions Answer Key

https://youtube.com/watch?v=GSm3V23MABQ

Conclusion: The Foundation of Financial Management

Mastering journalizing transactions is a crucial step towards achieving financial clarity and mastering the art of accounting. It’s the bedrock of accurate financial recordkeeping, providing a comprehensive and chronological record of all financial activities within a business. Journalizing is more than just a technical process; it’s a valuable tool for decision-making, audit compliance, and achieving financial transparency. As accounting software continues to evolve, journalizing is likely to become even more streamlined and efficient. Embracing the latest technology while maintaining a strong understanding of the fundamental principles of journalizing can empower you to effectively manage the financial health of any business.