Navigating the world of finance can be a complex process, especially when it comes to requesting essential documents like bank statements. Recently, I found myself in a situation where I needed to provide a bank statement for a loan application. The process seemed daunting, but after researching and delving into the specifics, I discovered that obtaining a bank statement is quite straightforward. This article will guide you through the process of crafting a compelling letter for requesting a bank statement.

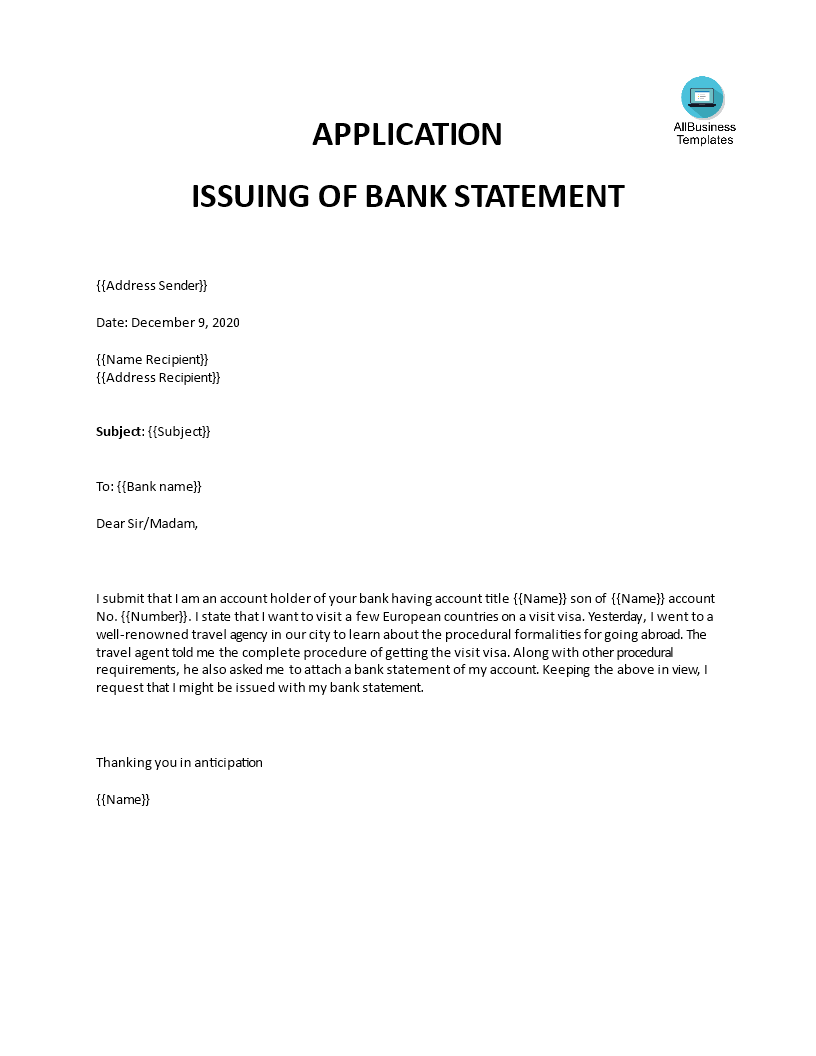

Image: www.vrogue.co

Whether you are applying for a loan, verifying your financial history, or need the statement for personal reasons, understanding how to request a bank statement effectively is crucial. This guide will equip you with the knowledge and templates to navigate this process smoothly.

Understanding the Importance of Bank Statements

What is a Bank Statement?

A bank statement is a detailed record of all transactions that have occurred in a specific bank account over a defined period. This document serves as a comprehensive record of your financial activities, outlining deposits, withdrawals, transfers, and any relevant fees associated with your account.

Why Do You Need a Bank Statement?

Bank statements are often required for various purposes, including:

- Loan Applications: Lenders use bank statements to assess your financial history and creditworthiness before approving a loan.

- Credit Card Applications: Issuers rely on bank statements to verify your income and repayment capacity before issuing a credit card.

- Rental Applications: Landlords often request bank statements to ensure you can afford the rent and to assess your financial stability.

- Verification of Income: Some employers may require bank statements as verification of your income for salary payments or tax purposes.

- Personal Financial Management: A bank statement can be valuable for tracking your spending habits, identifying potential fraudulent transactions, and ensuring accuracy in your personal financial records.

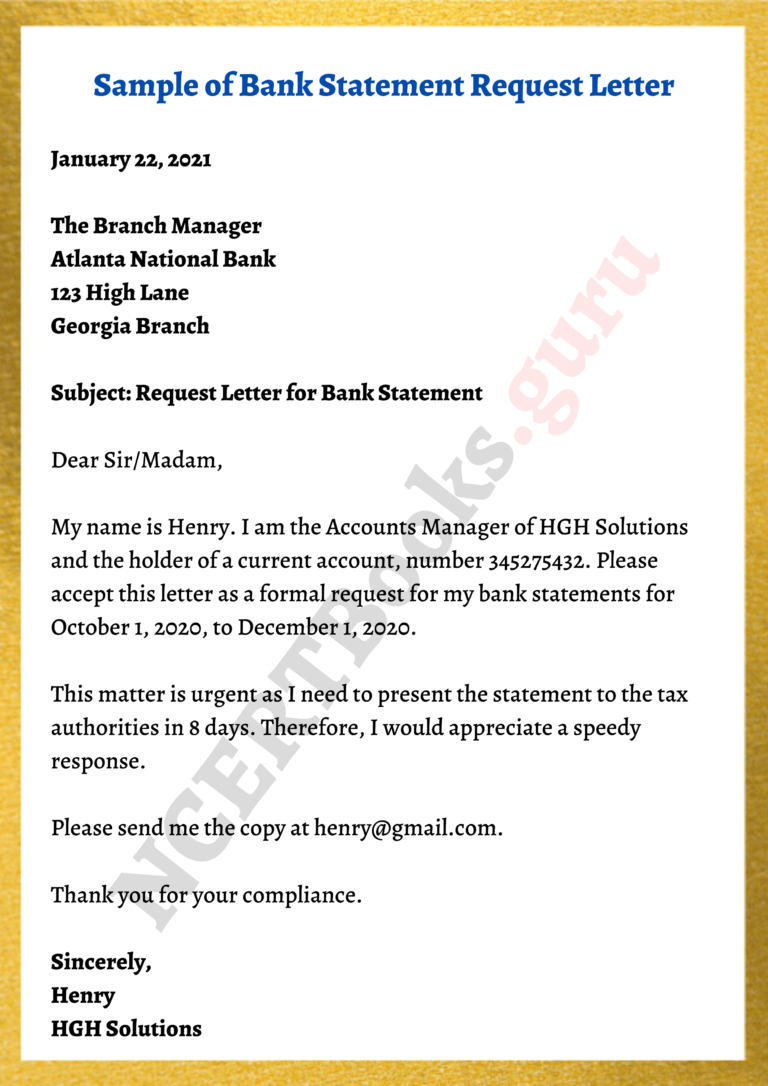

Image: www.ncertbooks.guru

Crafting a Letter for Request of Bank Statement

The Components of an Effective Request Letter

When writing a letter for requesting a bank statement, clarity, accuracy, and professionalism are key. Your letter should include the following components:

- Your Contact Information: Begin by providing your full name, address, phone number, and email address.

- Date: Date the letter to indicate when it was written.

- Bank Name and Address: Clearly identify the bank where you hold the account. Include its name and address.

- Account Details: Specify your account type, such as a checking or savings account, and provide your account number.

- Requested Period: Indicate the specific timeframe for the statement you need. Be precise about the start and end dates.

- Purpose of Request: Briefly explain why you require the bank statement. Be truthful and avoid any ambiguous language.

- Preferred Method of Delivery: State how you would prefer to receive the statement, whether through mail, email, or in-person pickup.

- Contact Information: Provide your contact information again for any further correspondence.

- Closing and Signature: Finish the letter with a polite closing, such as “Sincerely” or “Best Regards,” followed by your full name and signature.

Tips and Expert Advice for Requesting Bank Statements

To ensure your request is processed promptly and efficiently, keep the following tips in mind:

- Use Formal Language: Maintain a professional tone throughout the letter. Avoid slang or informal language.

- Be Concise: Keep your request concise and to the point. Avoid unnecessary details.

- Proofread Carefully: Before sending your letter, double-check for any grammatical errors or typos.

- Send via Certified Mail: For sensitive requests, consider sending your letter via certified mail to ensure delivery and receipt confirmation.

- Follow Up: If you haven’t received your statement within a reasonable timeframe, follow up with the bank through phone or email.

FAQ: Addressing Common Questions

Here are some frequently asked questions and their answers about requesting bank statements:

- “Can I request a bank statement online?”

Many banks offer online banking portals where you can access and download your statements electronically. Check with your bank for specific instructions.

<li><strong>"How long does it take to receive a bank statement?"</strong>

<p> The processing time can vary depending on the bank. Typically, you can expect to receive a statement within 5-10 business days. </p></li>

<li><strong>"What if I need a statement for a past period?"</strong>

<p> Most banks retain your statement records for several years. Contact your bank for information on retrieving older statements.</p></li>

<li><strong>"Can I get a duplicate bank statement?"</strong>

<p> Yes, most banks can provide you with a duplicate statement. Contact your bank directly for their procedure.</p></li>

<li><strong> "Is there a fee for requesting a bank statement?"</strong>

<p> Some banks may charge a small fee for providing a statement, especially for older statements. Inquire about potential fees beforehand.</p></li>Letter For Request Of Bank Statement

Conclusion

Obtaining a bank statement is a necessary process for various financial transactions. With this guide, you are equipped with the knowledge and templates to effectively craft a request letter and streamline the process. Remember to be clear, concise, and professional in your communication to ensure your request is met promptly.

Do you have any personal experiences or insights to share about requesting bank statements? Let’s discuss in the comments below!