Imagine this: you’ve diligently paid your insurance premiums for years, but life throws you a curveball. Maybe your financial situation has changed, you’ve found a more affordable policy, or you simply no longer need the coverage. Navigating the process of canceling an insurance policy can feel daunting, but it doesn’t have to be. This guide will break down everything you need to know about insurance policy cancellation, empowering you to handle the process with confidence.

Image: pdfprof.com

Canceling your insurance policy can be a crucial step in managing your finances. Whether you’re switching providers, downsizing your coverage, or simply deciding to forgo insurance entirely, understanding how to properly cancel your policy is vital. This article provides a comprehensive guide on how to approach this process, including a sample cancellation letter, practical tips, and essential considerations to ensure a smooth transition.

Understanding Insurance Policy Cancellation

Before diving into the specifics of a cancellation letter, let’s clarify what insurance policy cancellation entails. It essentially involves formally notifying your insurer of your decision to terminate your policy. This notification must be in writing and adhere to specific procedures outlined in your policy or by your state’s insurance regulations.

There are several reasons why you might want to cancel your insurance policy. Some common motivations include:

- Finding a cheaper or more comprehensive policy: The insurance market is dynamic, and you might discover a better deal with another provider.

- Changes in your circumstances: Perhaps you’ve sold your car, moved to a new location, or retired. These life events may affect your insurance needs.

- No longer needing coverage: If you’ve paid off a mortgage or have enough savings to cover unforeseen expenses, you might choose to discontinue your insurance policy.

Essential Information Before Cancelling

Before you pen your cancellation letter, gather the following critical information:

- Policy number: This unique identifier is essential for your insurer to identify your policy accurately.

- Cancellation date: You have the right to cancel your policy effective on a specific date. This date should be clearly stated in your letter.

- Reason for cancellation: While not mandatory in all cases, providing a brief explanation for your cancellation can be helpful, especially if you’re aiming for a smoother process.

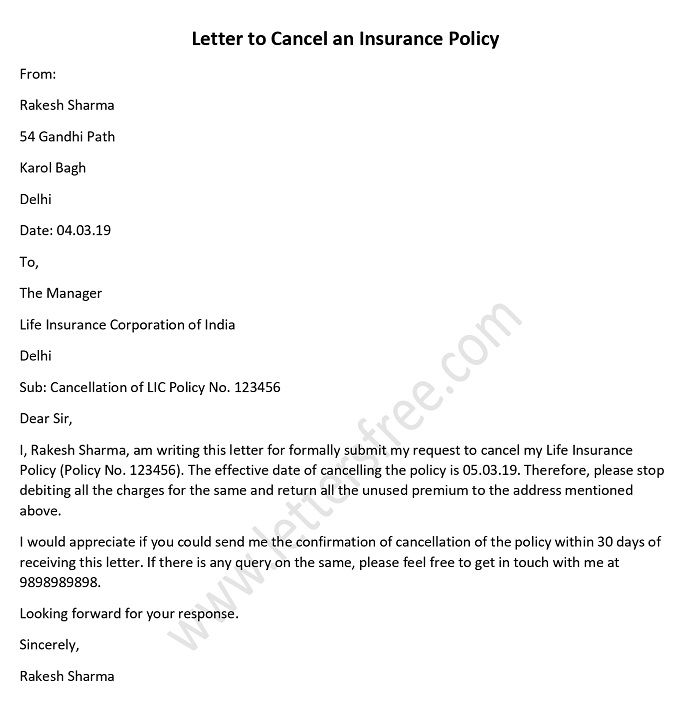

Example of Insurance Policy Cancellation Letter

Here’s a sample cancellation letter you can use as a starting point:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Cancellation of Policy Number: [Your Policy Number]

Dear [Insurance Company Name],

This letter is to formally request the cancellation of my insurance policy, number [Your Policy Number], effective [Cancellation Date].

[Optional: Briefly explain your reason for cancellation, if applicable. For example, “I am canceling my policy because I have recently purchased a new car with a more comprehensive insurance plan.”].

I understand that I may be responsible for any outstanding premiums or fees. I would appreciate confirmation of the policy cancellation date and any remaining financial obligations.

Please send any further communication regarding this matter to my email address, [Your Email Address], or phone number, [Your Phone Number].

Sincerely,

[Your Signature]

[Your Typed Name]

Image: simpleartifact.com

Important Considerations for Cancellation

Keep in mind these essential points when canceling your insurance policy:

- Cancellation Fees: Many insurance policies include a cancellation fee. This fee is typically outlined in your policy documents. Make sure to inquire about any potential cancellation fees before finalizing your decision.

- Pro-rata Refund: When you cancel your policy before its expiration date, you are usually entitled to a pro-rata refund. This means you receive a proportionate reimbursement for the unused portion of your premium.

- Grace Period: Most insurance companies offer a grace period for premium payments. Even if your payment is late, you might have a few days to make the payment before the policy officially lapses.

- Proof of Coverage: Retain a copy of your cancellation letter and any communication with your insurer as evidence of your cancellation request.

Expert Insights and Actionable Tips

- Check Your Policy Documents: Before contacting your insurer, thoroughly review your policy documents to understand the cancellation process, fees, and any potential ramifications.

- Contact Your Insurer: Reach out to your insurance company to confirm the cancellation procedure and any relevant deadlines.

- Review Your Insurance Needs: Once you cancel your policy, critically assess your insurance requirements. You might need to obtain new coverage if you’re still exposed to risk.

Example Of Insurance Policy Cancellation Letter

Conclusion

Canceling an insurance policy is an essential part of managing your finances and ensuring you have the right coverage for your needs. By following the steps outlined in this guide, you can effectively navigate the cancellation process and enjoy peace of mind knowing that you’ve successfully terminated your policy. Remember to keep a copy of all correspondence and double-check any potential fees or refund arrangements to avoid any unforeseen surprises.