Imagine this: you’ve carefully planned your finances, built a comfortable nest egg, and now you’re ready to ensure your loved ones are taken care of after you’re gone. But have you considered how those funds will be distributed? This is where the Bank of America beneficiary letter of instruction comes in, a vital tool for making your wishes clear and ensuring your legacy is passed on exactly as you intend.

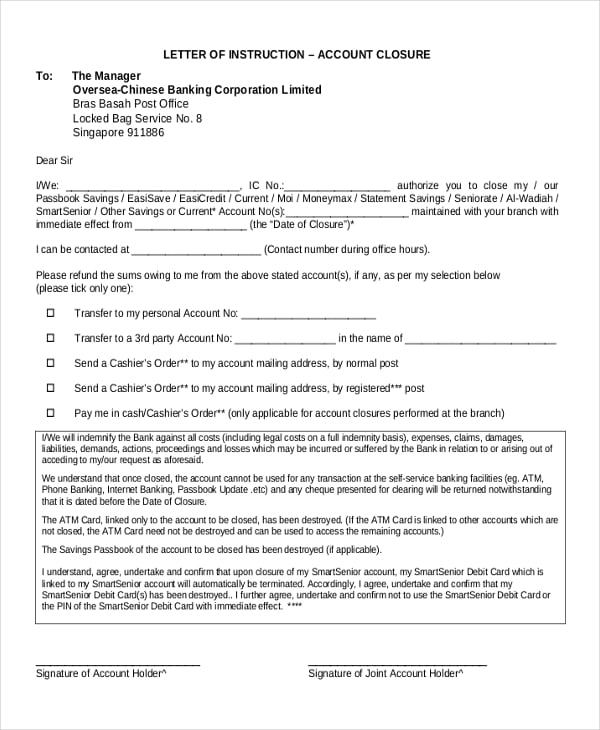

Image: mungfali.com

This letter plays a crucial role in defining who receives your assets upon your passing and ensures your financial resources reach the intended beneficiaries. It’s not just about finances; it’s about peace of mind knowing your loved ones are taken care of and your wishes are carried out after you’re gone.

Understanding Bank of America Beneficiary Letters

A Bank of America beneficiary letter of instruction, also known as a TOD (Transfer on Death) designation, allows you to name a specific individual or individuals who will inherit your assets held at Bank of America upon your death. Think of it as a direct instruction that transcends the typical probate process, streamlining the distribution of your assets.

These letters function as a simple yet essential part of your estate planning, providing clarity and direction for your financial legacy. They work in conjunction with other estate planning documents like wills and trusts, ensuring a comprehensive roadmap for the distribution of your assets.

Benefits of a Beneficiary Letter

-

Streamlined Inheritance: A beneficiary letter eliminates the need for lengthy probate proceedings, allowing your assets to be transferred directly to your chosen beneficiaries. This simplifies the process and avoids costly delays.

-

Clear Instructions: This letter clearly outlines your wishes, leaving no room for confusion or disputes. It provides a definitive roadmap for the distribution of your assets, minimizing potential conflicts among beneficiaries.

-

Flexibility and Control: You have complete control over who inherits your assets. This empowers you to dictate your legacy and ensure your financial resources are allocated as per your desires.

-

Protection Against Unexpected Events: This letter serves as a safeguard in the event of unexpected circumstances. It ensures your assets are distributed according to your wishes regardless of any unforeseen events or changes in family dynamics.

Types of Accounts Covered by Beneficiary Letters

Bank of America beneficiary letters are applicable to a range of account types, including:

-

Checking and Savings Accounts: You can designate beneficiaries for your checking and savings accounts, ensuring the funds are transferred directly to them upon your passing.

-

Certificates of Deposit (CDs): If you have fixed-term deposits like CDs, you can name beneficiaries who will receive the principal and accrued interest upon their maturity.

-

Individual Retirement Accounts (IRAs): It’s essential to name beneficiaries for your IRAs as this determines how the funds will be distributed and impacts tax implications.

-

Brokerage Accounts: For investments held in brokerage accounts, you can specify beneficiaries who will inherit your securities and other holdings.

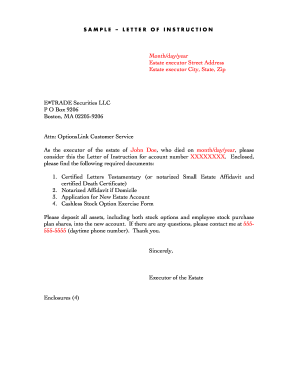

Image: simpleartifact.com

Key Considerations for Writing a Beneficiary Letter

-

Thorough Research: Before filling out a beneficiary letter, take the time to understand the implications and ensure it aligns with your overall estate plan.

-

Account Review: Regularly review your account beneficiary designations, particularly as your life circumstances may change. Update them as needed to reflect your current wishes.

-

Legal Advice: Consult with an estate planning attorney to discuss your estate plan and ensure your beneficiary letters are correctly drafted and in alignment with your goals.

-

Beneficiary Communication: Consider communicating your beneficiary choices with your loved ones, allowing them to understand your intentions and ensuring they are prepared for the future.

How to Create a Bank of America Beneficiary Letter

-

Access Online Banking: Log into your Bank of America online banking account and navigate to the “Accounts” section.

-

Locate the Beneficiary Designation: Within your account details, you should find a section dedicated to beneficiary designations.

-

Complete the Form: Carefully fill out the beneficiary designation form, providing accurate details of your chosen beneficiaries. Include their complete names, addresses, and Social Security numbers.

-

Submit the Letter: Once you’ve completed the form, submit it securely through Bank of America’s online platform.

-

Confirmation: Bank of America will send you confirmation of your beneficiary designations, keeping a record of your instructions for future reference.

Actionable Tips for Beneficiary Letter Success

-

Regular Review: Life changes, and so do your priorities, so reviewing your beneficiary designation letters at least every few years is crucial. This ensures your wishes remain current and aligned with your changing needs.

-

Family Communication: Communicating your beneficiary choices with your loved ones can help avoid potential misunderstandings or disputes, fostering transparency and peace of mind.

-

Professional Guidance: If you have complex financial situations or concerns about beneficiaries inheriting your assets, seek professional guidance from a financial advisor or estate planning attorney.

Bank Of America Beneficiary Letter Of Instruction

Final Thoughts: A Legacy of Love and Security

A Bank of America beneficiary letter of instruction is more than just a legal document; it’s a powerful testament to your love and care for your loved ones. It’s an opportunity to leave a lasting legacy, ensuring your financial resources are distributed as per your wishes, offering peace of mind to both you and your loved ones. Take the time to understand the implications, carefully execute your beneficiary designations, and revisit your choices periodically to ensure they align with your evolving financial goals and life circumstances.