The weight of student loan debt can be a heavy burden, not just financially, but also in terms of your credit score. It can impact everything from securing a loan to renting an apartment. Imagine this: you’ve finally paid off your student loans, and you’re feeling triumphant. You’re ready to start rebuilding your financial life and credit score, but there’s a snag – those loans are still haunting your credit report, negatively impacting your financial standing.

Image: nationalgriefawarenessday.com

This is a common frustration that many individuals face. It can be disheartening to see the lingering mark of student loans on your credit history even after paying them off. Fortunately, it’s not impossible to get them removed. This article will provide you with a sample letter you can use to request the removal of your paid-off student loans from your credit report. We’ll also delve into the process, the potential challenges, and the best strategies to achieve this crucial financial goal.

Understanding Credit Reporting and Student Loans

Your credit report is a detailed document that outlines your credit history. It contains information about your loans, credit cards, payment history, and any other financial obligations. Credit reporting agencies such as Experian, Equifax, and TransUnion compile this data from various sources, including banks, credit card companies, and loan providers.

Student loans are often considered “installment loans,” meaning they require regular monthly payments. These payments are reported to the credit bureaus and contribute to your credit score. However, once you’ve fully paid off your student loans, your payment history is marked as “closed” or “paid in full.” Ideally, this should result in the loans being removed from your credit report, but it doesn’t always happen automatically.

Why Remove Student Loans from Your Credit Report?

Improving Credit Score

A higher credit score can lead to lower interest rates on loans, better credit card terms, and even easier approval for renting an apartment. Keeping paid-off student loans on your credit report can unnecessarily drag down your score, especially if you’re rebuilding your credit after a blemish like a late payment or default.

Image: creditrepairpartner.com

Cleaning Up Your Financial Record

Having paid-off student loans on your credit report can be a constant reminder of past financial struggles. Removing them can provide a sense of closure and allow you to move forward with a cleaner financial slate. It also helps to eliminate the worry of potential lenders or landlords seeing those loans and misinterpreting your financial situation.

Simplifying Your Financial Life

By removing paid-off student loans, you simplify your financial record and make it easier to understand your overall financial health. Less clutter on your credit report makes it easier to track your credit score and identify any potential issues.

Steps to Remove Paid-off Student Loans from Your Credit Report

The first step is to confirm that the loans have been paid in full. Contact your loan servicer and request a letter of confirmation indicating that the loans have been completely paid off.

Next, obtain a copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Review your report carefully and note the specific student loan accounts that you want to remove.

Now, draft a formal letter to each credit bureau requesting the removal of the paid-off student loans. The letter should contain the following information:

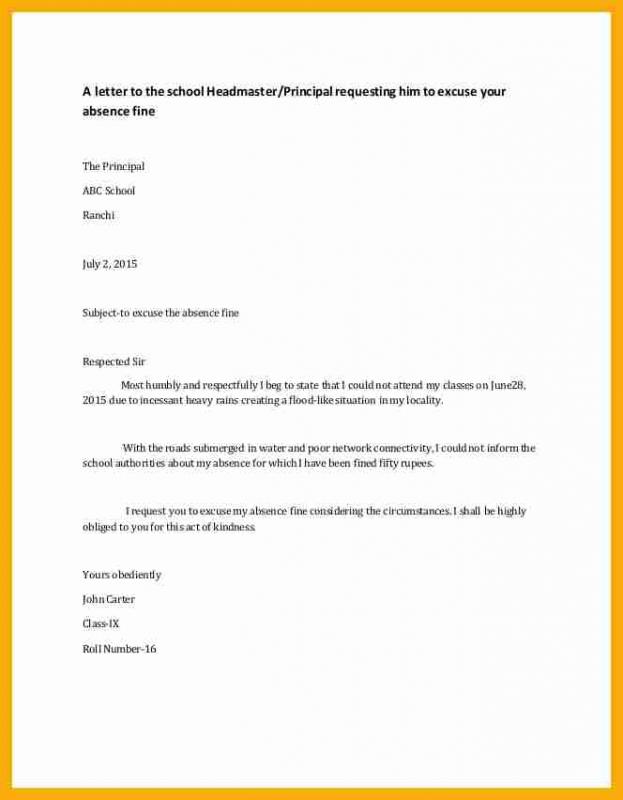

Sample Letter to Remove Student Loan from Credit Report

To: [Credit Bureau Name]

[Credit Bureau Address]Dear Credit Bureau Representative,

This letter is to formally request the removal of the following student loan accounts from my credit report:

- Account Number: [Loan Account Number]

- Loan Servicer: [Loan Servicer Name]

I have provided proof of full payment from my loan servicer (see attached documentation). These loans were paid in full on [Date of Full Payment].

I kindly request that these accounts be removed from my credit report as they are no longer accurate and negatively impacting my credit score.

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]

Supporting Documentation for your Letter

Include supporting documents with your letter, such as:

- A copy of the loan payoff statement

- A letter of confirmation from your loan servicer

- Any other relevant documentation that verifies the full payment of the loans

Send your letter via certified mail with return receipt requested so you have proof that it was received by the credit bureau. Keep a copy of the letter and all supporting documents for your records.

The credit bureaus are usually required to investigate your request within 30 days to verify the accuracy of the information. You will receive a response, and if the request is approved, the paid-off student loan accounts will be removed from your credit report.

What to Do if Your Request is Denied

It’s possible that your request to remove paid-off student loans may be denied. There are several reasons for this, including:

- Errors in reporting: The credit bureau may have incorrect information on their record, which can lead to a denial.

- Ongoing disputes: If you’re involved in a dispute with your loan servicer, it may prevent the removal of the loans from your credit report.

- Legal obligations: In some cases, creditors may be legally required to keep paid-off loans on credit reports for a certain period of time.

If your request is denied, don’t give up. Review the denial letter carefully to understand the reason for the denial. If you believe an error has occurred, you can file a dispute with the credit bureau through their online portal or by phone.

The Fair Credit Reporting Act (FCRA) gives you the right to dispute inaccuracies on your credit report. If the dispute is deemed valid, the credit bureau is obligated to investigate and make necessary corrections. You can also consider pursuing a legal case if your dispute is not resolved satisfactorily.

Tips for Removing Paid-off Student Loans from your Credit Report

Here are some tips to improve your chances of success:

- Be meticulous in your documentation: Make sure your letter includes all necessary details, including your loan servicer, account number, payment date, and supporting documentation.

- Be patient: The credit reporting process can take time, so don’t expect immediate results.

- Stay organized: Keep track of all correspondence and deadlines for response.

- Don’t be afraid to seek help: If you find the process overwhelming, consider seeking assistance from a credit counselor or attorney specializing in credit law.

Removing paid-off student loans from your credit report can be a challenging process, but it is possible. Armed with the information and sample letter provided above, you can approach this task with confidence and increase your chances of achieving a clean slate.

Frequently Asked Questions (FAQs)

Q: What information should I include in my letter to the credit bureau?

A: Your letter should include your full name, address, contact information, the specific student loan accounts you want to remove, the account numbers, the loan servicer’s name, and the date of full payment. You should also include a statement that you have provided proof of full payment from your loan servicer.

Q: How long does it take for the credit bureau to process my request?

A: Credit bureaus are usually required to investigate your request within 30 days. However, it may take longer depending on the complexity of the case.

Q: Can I file a dispute with the credit bureau if my request is denied?

A: Yes, you have the right to file a dispute with the credit bureau if you believe that the information on your credit report is inaccurate or incomplete. The Fair Credit Reporting Act (FCRA) gives you this right, and the credit bureau is obligated to investigate your dispute.

Q: Can I remove student loans from my credit report before I pay them off?

A: No, you can’t remove student loans from your credit report before they are fully paid off. The credit reporting system is designed to reflect your financial history, and paid-off student loans will have a positive impact on your credit score.

Q: What if I don’t have documentation proving that my student loans were paid off?

A: If you don’t have proof of payment, you can contact your loan servicer and request a letter of confirmation. You can also check your loan documents or bank statements for evidence of payment.

Sample Letter To Remove Student Loan From Credit Report

Conclusion

Removing paid-off student loans from your credit report can be a valuable step towards a healthier financial life. By understanding the process, drafting a well-structured letter, and exercising your rights under the Fair Credit Reporting Act, you can increase your chances of achieving a clean slate and improving your credit score.

Are you struggling to remove paid-off student loans from your credit report? Have you encountered any challenges or setbacks? Share your experiences in the comments section below. Let’s continue the conversation and help improve credit scores for everyone!