Ever found yourself in a situation where you needed a copy of your bank statement for a specific period, but couldn’t recall the exact details of the transactions or simply couldn’t find the original document? Don’t worry, it happens to the best of us. Thankfully, banks understand the importance of providing their customers with access to their financial records. This is where a carefully crafted bank statement request letter comes into play. It acts as a formal communication to your bank, outlining your need for a statement and specifying the details you require.

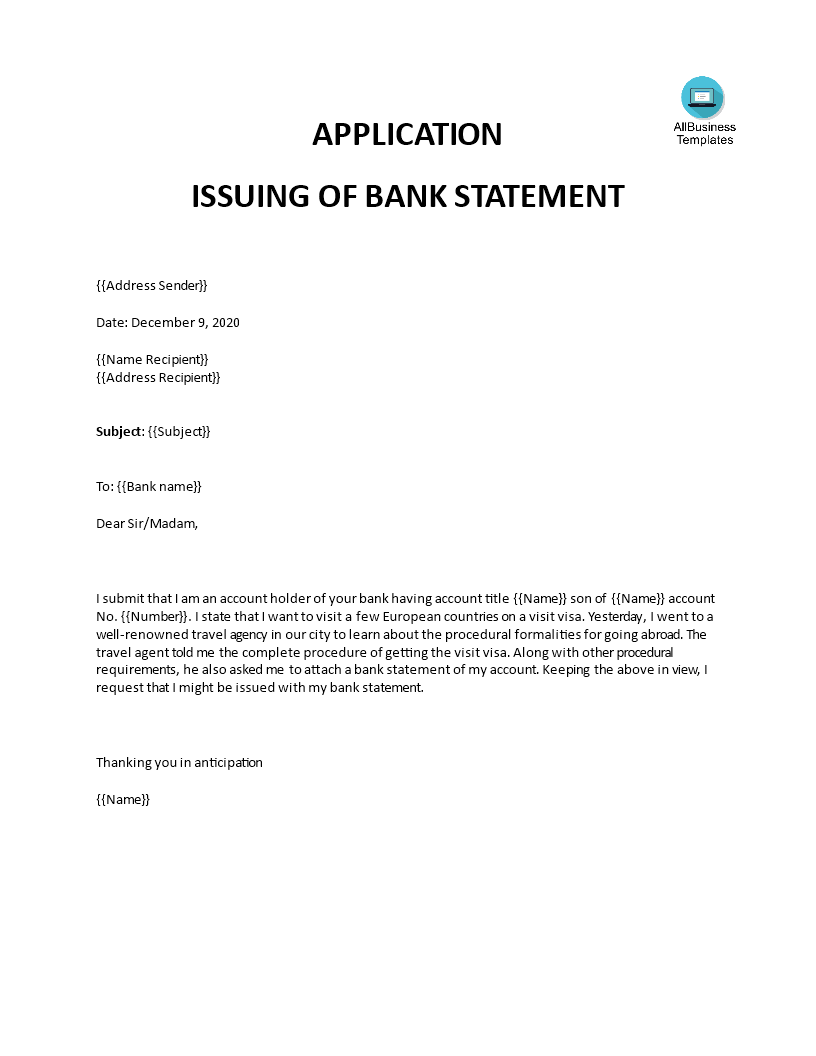

Image: www.allbusinesstemplates.com

A sample letter for requesting a bank statement can be a valuable tool for navigating this process. It provides a structured template that ensures you include all the necessary information, preventing any delays or misunderstandings. Whether you need a copy for tax purposes, a loan application, or simply to track your spending, this guide will equip you with the knowledge to write a clear, concise, and effective request letter.

Understanding the Importance of a Bank Statement

The Many Uses of a Bank Statement

Bank statements are more than just a record of your transactions; they serve as a crucial piece of documentation for a variety of situations. Here are some common scenarios where you might need a copy of your bank statement:

- Tax Filing: Bank statements are essential for preparing and filing your income tax returns. They provide proof of income and expenses, helping you accurately calculate your tax liability.

- Loan Application: When applying for a loan, lenders often require you to provide recent bank statements to assess your financial standing and creditworthiness.

- Rental Applications: Landlords may ask for bank statements to verify your ability to pay rent, ensuring you’re financially responsible.

- Proof of Payment: If you need to prove that you made a specific payment, a bank statement can serve as concrete evidence. This could be useful for resolving disputes with businesses or service providers.

- Tracking Spending: Analyzing your bank statement can help you gain a better understanding of your spending habits, identify areas where you might be overspending, and track your financial progress.

Types of Bank Statements

Banks typically offer different types of bank statements to cater to specific needs. These might include:

- Monthly Statement: This is the most common type of statement, summarizing your transactions for a specific calendar month.

- Periodic Statement: Some banks offer periodic statements, providing a summary of your activity for a custom period, such as three months or six months. This might be particularly useful for tracking income and expenses over longer periods.

- Real-time Statement: With online banking platforms, you can often access real-time statements, providing an up-to-the-minute view of your transactions.

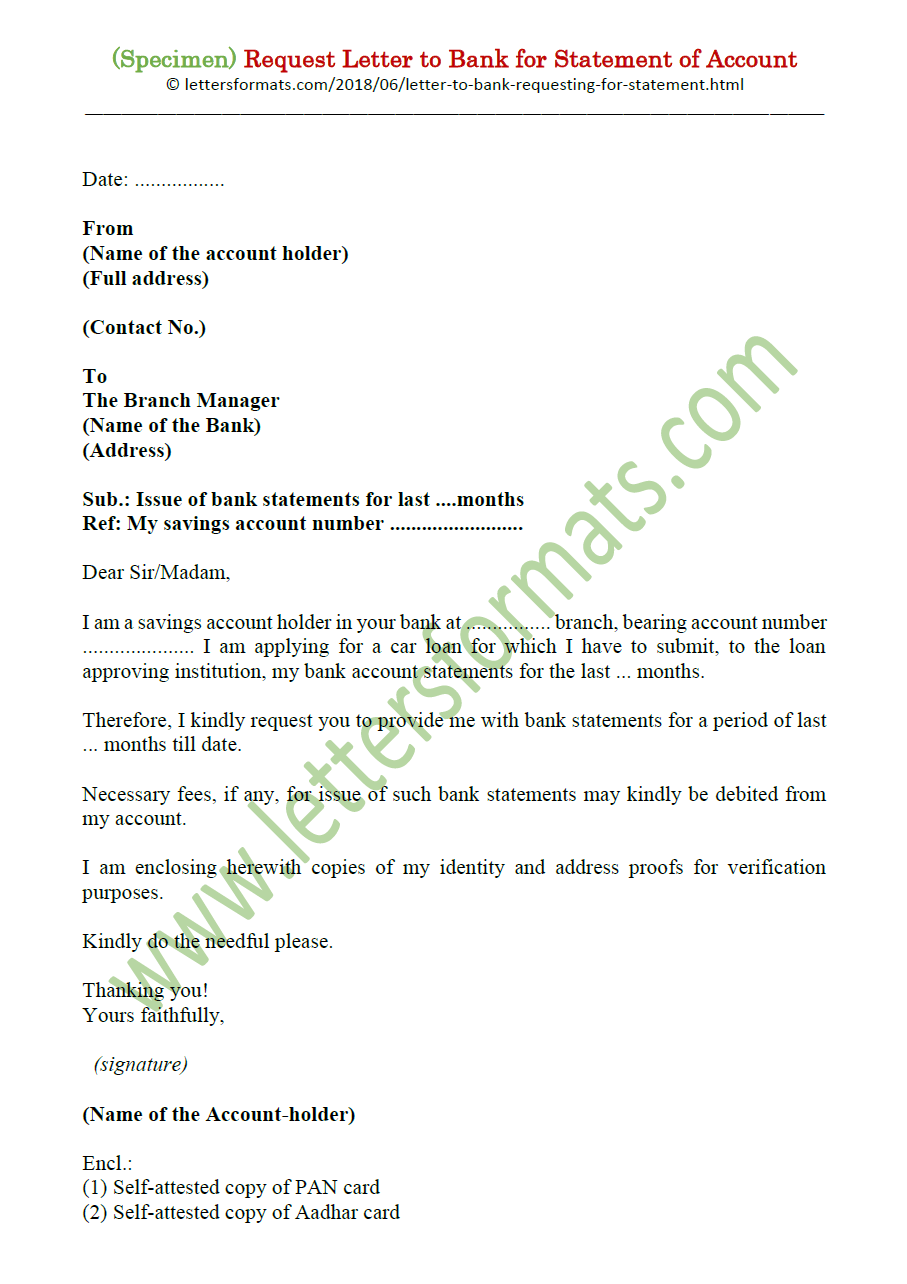

Image: www.lettersformats.com

Crafting a Sample Letter for Requesting a Bank Statement

Now that you understand the importance of bank statements, let’s dive into crafting an effective request letter. A well-written letter will significantly increase your chances of getting a prompt and accurate response from your bank.

Key Elements of a Bank Statement Request Letter

A standard bank statement request letter should include the following essential elements:

- Your Contact Information: Start by providing your full name, address, phone number, and email address. This allows the bank to contact you easily if they need further clarification or need to inform you about the status of your request.

- Your Account Information: Clearly state your account type, account number, and branch address (if applicable). This helps the bank locate your account quickly and efficiently.

- Statement Period: Specify the exact dates for which you require the bank statement. State the “from” and “to” dates clearly to avoid any confusion. For example, “Statement for the period from January 1st, 2023, to January 31st, 2023.”

- Reason for Request: Briefly explain why you need the bank statement. While you don’t need to go into extensive detail, providing a clear justification helps the bank understand the urgency of your request.

- Preferred Delivery Method: Indicate your preferred method of receiving the statement: by mail, email, or in person. If you choose email, provide a specific email address where you would like the statement to be sent. Remember to verify that the provided email address is correct.

- Closing: A simple and polite closing line is appropriate. For example, “Thank you for your time and assistance,” or “Sincerely,” followed by your full name.

Sample Letter Format: A Comprehensive Template

To make it easier, here is a sample letter template you can use as a starting point:

Sample Letter for Requesting Bank Statement

Your Name

Your Address

Your Phone Number

Your Email Address

Date

Bank Name

Bank Address

Subject: Request for Bank Statement

Dear [Bank Representative],

I am writing to request a copy of my bank statement for the period from [Start Date] to [End Date]. My account details are as follows:

- Account Type: [State your account type, e.g., Checking Account, Savings Account]

- Account Number: [Your account number]

- Branch Address: [Your branch address, if applicable]

I require this statement for [Brief explanation of the reason for your request].

Please send the statement to me via [Your preferred delivery method: mail, email, or in person]. If sending by email, my address is [Your email address].

Thank you for your time and assistance.

Sincerely,

Your Full Name

Additional Tips for Effective Letter Writing

- Clarity is Key: Use simple, clear language and avoid any technical jargon. The bank representative should understand your request without needing to interpret any complex wording.

- Proofread Carefully: Before sending your letter, proofread it carefully for any grammatical errors or typos. Mistakes could create confusion and delay your request.

- Formal Tone: Maintain a polite and professional tone throughout the letter. This demonstrates respect for the bank and their staff.

- Retain a Copy: Always keep a copy of your request letter for your records. This can help you track the status of your request and provide proof of communication if any issues arise.

Alternative Methods for Obtaining Bank Statements

While sending a formal letter is a traditional and reliable approach, there are other methods for obtaining your bank statements. Many banks offer convenient online services for accessing and downloading statements for a specific period.

Online Banking:

Most banks provide online banking platforms where you can easily access and view your recent statements, as well as download or print them. This method is typically quick and straightforward. Check your bank’s website for details on how to access your statements online.

Mobile App:

Many banks have mobile applications that allow you to manage your accounts, including accessing and downloading bank statements. This is a convenient option if you’re on the go.

Customer Service:

If you prefer to speak with a bank representative directly, you can contact their customer service department. They can guide you through the process of requesting your statements and might even be able to send them to you electronically.

Contacting the Bank Directly for Additional Support

If you have any questions or encounter difficulties in obtaining your bank statements, don’t hesitate to contact your bank’s customer service department. They can provide personalized assistance and guide you through the appropriate procedures. Be prepared to provide the necessary information, including your account details, preferred method of receiving the statement, and the specific period you need the statement for.

Sample Letter For Requesting Bank Statement

Conclusion: Empowering Yourself with Bank Statement Access

Having access to your bank statements is essential for managing your finances effectively, satisfying legal and financial obligations, and making informed decisions about your money. By understanding the importance of bank statements and following the guidelines for writing an effective request letter, you can ensure you have the information you need when you need it. Whether you choose to send a formal letter or utilize your bank’s online services, the process is streamlined and accessible. Keep in mind that maintaining accurate and organized records of your financial transactions is crucial for financial health and peace of mind.