Imagine: you’ve poured your heart and soul into a project, delivered exceptional work, and now the invoice is due. But life, in its unpredictable nature, throws a curveball—a sudden financial crunch, an unexpected expense, or a delay in your own income stream. The deadline looms, and a wave of anxiety washes over you. What do you do? This is where the art of crafting a well-written letter requesting an extension of time for payment comes into play. It’s a delicate dance of honesty, respect, and clear communication, aimed at maintaining a positive relationship with your client while securing a crucial extension.

Image: mavink.com

Requesting an extension on a payment isn’t something most people find enjoyable. It can feel uncomfortable and even a bit embarrassing. However, understanding the nuances of a persuasive letter and the importance of building strong client relationships can help you navigate this situation with grace and professionalism. This article will provide you with a comprehensive guide on writing an effective sample letter requesting an extension of time for payment, empowering you to handle these delicate situations with confidence.

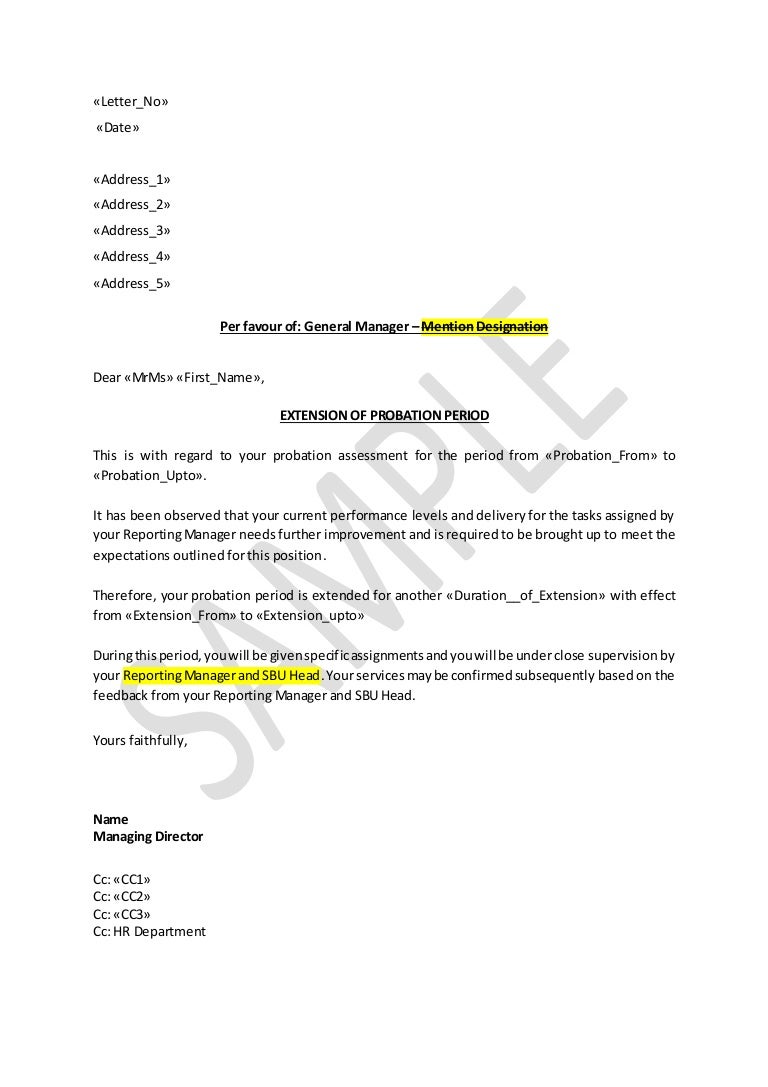

Understanding the Importance of a Well-Crafted Letter

In the world of business, communication is key. A well-crafted letter serves as your advocate, presenting your situation with clarity and professionalism, leaving a positive impression on your client. A thoughtfully written letter demonstrates your respect for their time and the value you place on the existing relationship. It’s a chance to show that you are taking responsibility for your situation and actively working towards a solution.

Structure of a Sample Letter Requesting Extension of Time for Payment

Remember, a concise and clear letter is best. It should provide all the necessary information without being excessively verbose. Here’s a recommended structure:

1. Salutation

-

Begin by addressing the recipient formally, using their name and title if applicable. For example:

- Dear [Client Name],

- Dear Mr./Ms. [Last Name],

Image: www.signnow.com

2. Introduction

-

Briefly state the purpose of your letter—that you are requesting an extension on the payment due on [date].

- Example: “I am writing to request a brief extension for the payment of invoice # [invoice number], which is currently due on [date].”

3. Explanation

-

Clearly and concisely explain the reason for your request. Be truthful and avoid making excuses.

- *Example: “I’ve recently encountered [briefly explain financial hardship, like a delay in income, an unexpected expense, etc.]. As a result, I am unable to meet the current payment deadline.”

4. Proposed Extension

-

State your desired extension clearly.

- *Example: “I would greatly appreciate a [number]-day extension until [new date]. This will allow me to [briefly explain how the extension will help, e.g., receive a large payment, work out a payment plan, etc.].”

5. Assurances and Future Actions

-

Reassure your client that you are committed to honoring the payment and that you will fulfill your obligations as agreed upon.

- *Example: “I want to assure you that I am committed to fulfilling my financial obligations and can confidently confirm that the full payment will be made on or before [new date].”

6. Thank You and Contact Information

-

Thank your client for their understanding and express your appreciation for their continued business.

-

Include your contact information (phone number, email address) so they can reach you if they require clarification.

- *Example: “Thank you for your time and consideration. Please feel free to contact me at [email address] or [phone number] if you have any questions or need to discuss this further.”

7. Formal Closing

-

Use a formal closing, such as:

- Sincerely,

- Respectfully,

- Best Regards,

8. Your Name and Signature

- Type your full name and sign the letter below your typed name in blue ink.

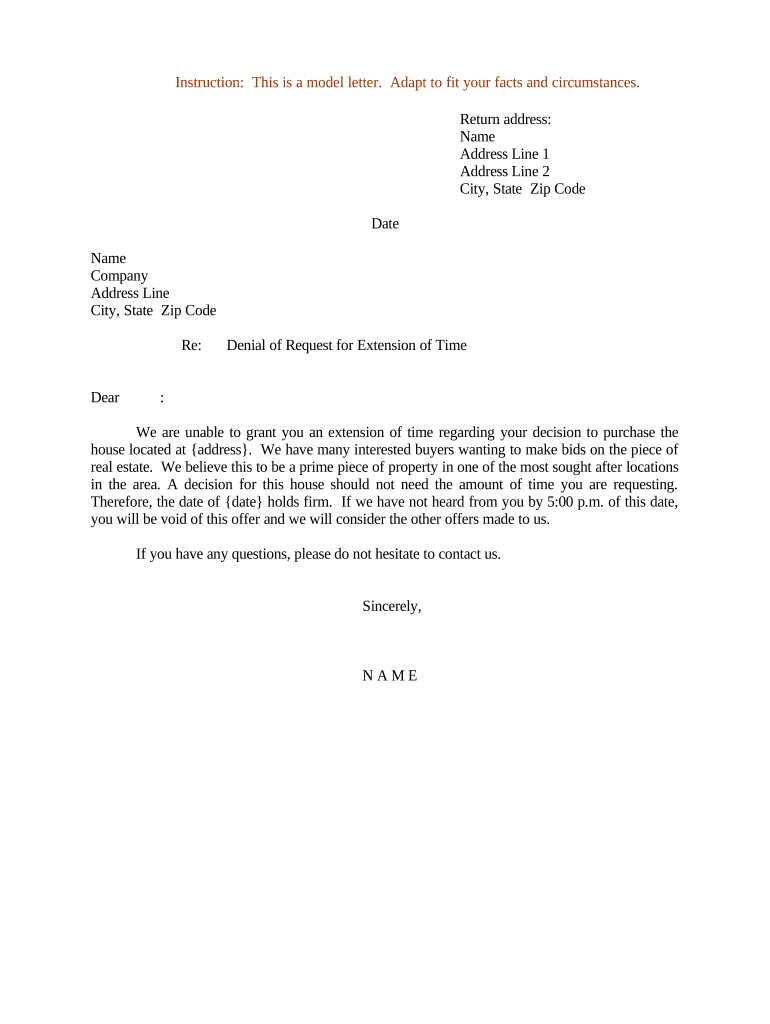

Sample Letter for Your Reference

Here is a sample letter you can adapt to your specific situation:

Dear [Client Name],

I am writing to request a brief extension for the payment of invoice # [invoice number], which is currently due on [date]. I have experienced [briefly explain your financial hardship without making excuses]. As a result, I am unable to meet the current payment deadline.

I would be grateful for a [number]-day extension to [new date], which will allow me to [briefly explain how the extension will help, e.g., receive a large payment, work out a payment plan, etc.].

I want to assure you that I am committed to fulfilling my financial obligations and can confidently confirm that the full payment will be made on or before [new date]. I appreciate your understanding and flexibility in this matter.

Thank you for your time and consideration. Please feel free to contact me at [email address] or [phone number] if you have any questions or need to discuss this further.

Sincerely,

[Your Name]

Essential Tips for Effective Communication

- Be Honest and Transparent: Avoid making excuses or trying to hide the true reason for your request. Honesty builds trust and strengthens client relationships.

- Show Humility and Appreciation: Acknowledge the inconvenience your request is causing and express sincere gratitude for their understanding.

- Be Specific: Clearly state the requested extension date and your plan for making the full payment within that timeline.

- Maintain Professionalism: Use formal language throughout the letter and avoid using slang, jargon, or overly casual language.

- Proofread Carefully: Before sending, review your letter for any grammatical errors, typos, or inconsistencies.

Negotiating with Your Client

Sometimes, a simple extension might not be enough. If you anticipate needing additional time to make the full payment, a clear and open dialogue with your client is crucial. Here are some points to consider:

- Payment Plan: Do you need to propose a structured payment plan to gradually settle the invoice?

- Negotiated Payment Terms: Can you negotiate a revised payment schedule that works better for both parties?

- Compromise: Are there any concessions you can offer in exchange for a more flexible payment schedule?

By approaching the conversation with respect and a collaborative mindset, you can often work out a solution that accommodates your current needs while ensuring the client feels heard and respected.

Navigating Difficult Situations

Not every request for an extension is accepted. If you face a negative response, it’s important to understand the reason behind the refusal. It could be:

- Prior History: If you have a history of missed payments or financial difficulties, the client may be hesitant to grant further extensions.

- Contractual Obligations: Some contracts have strict payment terms that may not allow for flexibility.

- Business Relationship Dynamics: The client may be experiencing their own financial strains or have a specific policy against extensions.

If your request is denied, it’s wise to approach the situation with professionalism and grace. Acknowledge their decision and explore alternative solutions, such as:

- Re-negotiate: Try to understand their concerns and present alternative proposals or solutions that address their needs.

- Seek Alternative Funding: Consider options like short-term loans or financial assistance programs to cover the immediate expense.

- Prioritize Payment: Allocate available funds to prioritize the outstanding payment as soon as possible.

Maintaining Positive Client Relationships

Open and honest communication is key to building and maintaining positive client relationships. Keep these important points in mind:

- Be Proactive: If you foresee a potential financial difficulty, reach out to your client early on. Open communication prevents surprises and allows for potential solutions.

- Respect Their Time: Don’t wait until the last minute to request an extension. Give them ample time to process your request and make a decision.

- Follow Through on Promises: If you promise a payment by a certain date, ensure you follow through. Building trust takes time, but breaking it can be quick.

Sample Letter Requesting Extension Of Time For Payment

Conclusion

Requesting an extension of time for payment can be a delicate situation to navigate. However, with thoughtful communication, a respectful attitude, and a clear understanding of your client’s needs, you can present your request effectively and maintain a strong business relationship. Remember, honest communication and a commitment to fulfilling your financial obligations are key to building trust and navigating these situations with professionalism and grace.