Imagine this: You’ve meticulously tracked your expenses, diligently maintained your financial records, and now, it’s time to present a clear picture of your financial standing. A statement of account acts as your financial ambassador, communicating the status of your finances with precision. But how do you craft a statement of account that’s not only accurate but also visually appealing and easy to understand? This is where the “letter format” comes in – a powerful tool for transforming your financial data into a compelling narrative.

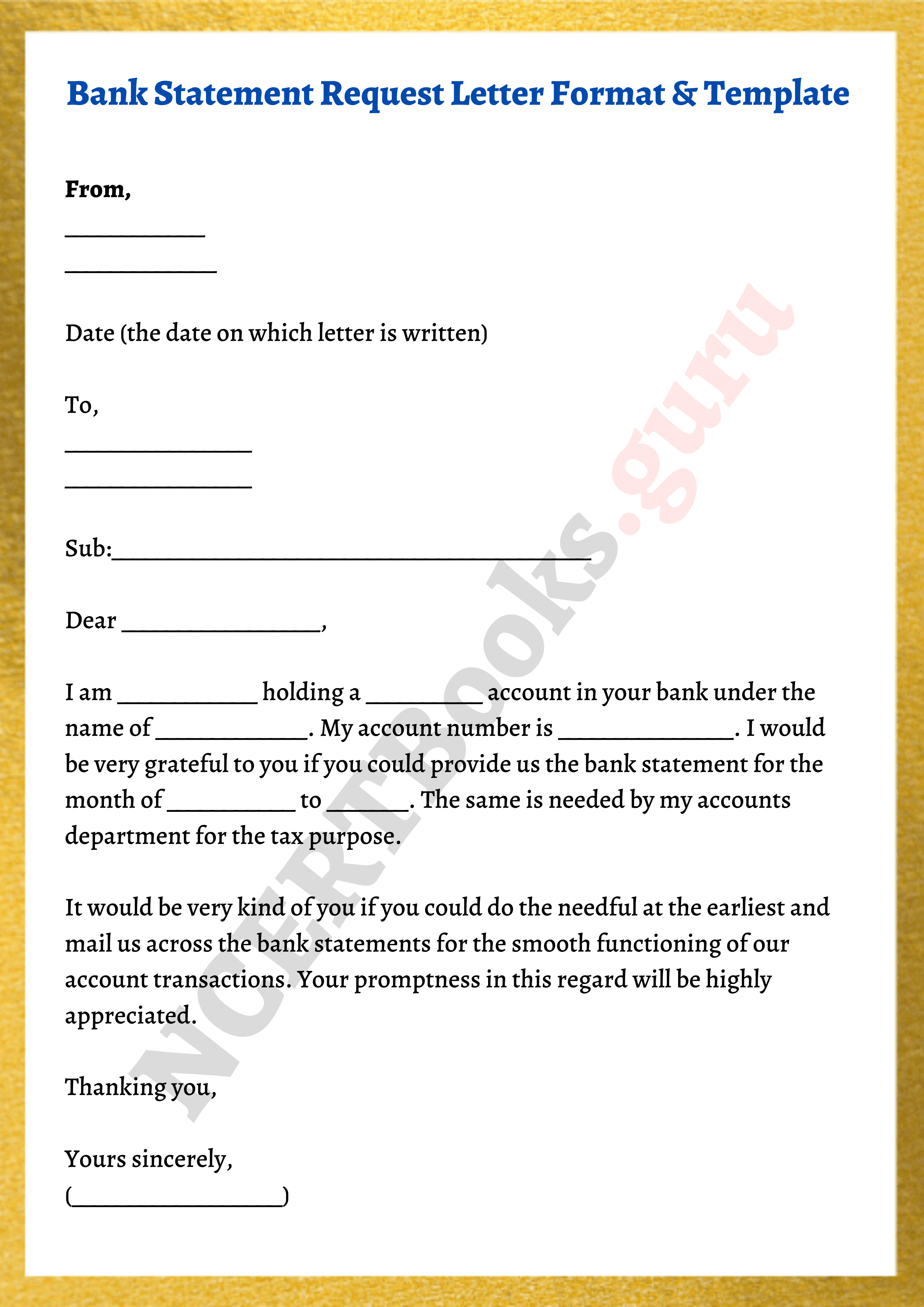

Image: www.pinterest.com

A statement of account isn’t just a dry list of numbers. It’s a powerful document that can influence decisions, build trust, and foster successful relationships. Whether you’re an individual managing personal finances, a business owner seeking to track revenue, or an accountant simplifying complex transactions, understanding the art of crafting a statement of account in a letter format can dramatically enhance your financial communication.

Unlocking the Power of a Letter Format for Your Statement of Account

The letter format for a statement of account goes beyond the traditional tabular presentation. It elevates your financial data by weaving a narrative that resonates with clarity and purpose. Here’s a breakdown of the key elements that make a letter format statement of account stand out:

1. The Formal Header:

- The Date: Begin with a prominent date at the top right corner of the document. This sets the context for the period covered by the statement.

- The “To” Line: Clearly state the recipient’s name and address. This establishes the intended audience of the statement.

- The “From” Line: Include the sender’s name, address, and contact information. This ensures transparency and facilitates communication. A company letterhead can be used to enhance professionalism.

2. A Concise and Clear Subject Line:

- The Purpose: A strong subject line summarizes the content of the statement in a few words, for example: “Statement of Account for [Month/Year]” or “Statement of Account – Invoice [Number]”.

3. A Welcoming Salutation:

- Formal Address: Begin with a standard salutation like “Dear [Recipient’s Name]” to maintain a professional tone.

4. A Clear Introduction:

- Purpose and Scope: Start by explaining the purpose of the statement and the period it covers. For example, “This statement summarizes your account activity for the month of [Month, Year]” or “This statement details the transactions related to your invoice [Number]”

- Account Summary: Provide a brief overview of the account’s current standing, including the opening balance, any payments received, and the current outstanding balance. This sets the stage for the detailed breakdown that follows.

5. A Detailed Transaction Breakdown:

- Organized by Date: Arrange transactions in chronological order, with the most recent date listed first. This allows for easy tracking of activity.

- Column Headers: Use clear column headers to label each category (e.g., Date, Description, Debit, Credit, Balance). This ensures easy readability and comprehension.

- Descriptions: Use concise but informative descriptions for each transaction, specifying the nature of the activity, to avoid ambiguity.

6. Clear Visual Cues:

- Formatting: Employ spacing, bullet points, or indents to improve readability and separate sections logically.

- Bolding and Underlining: Use bolding and underlining strategically to highlight important information, such as payment due dates or totals.

- Tables: If dealing with a large volume of transactions, present data in well-formatted tables or charts for greater clarity.

7. Detailed Account Information:

- Account Numbers: Include the relevant account numbers (e.g., bank account, customer account) to maintain accuracy and identification.

- Contact Information: Provide contact information (email, phone, fax) to facilitate communication regarding any inquiries related to the statement.

8. Clear Closing and Signature:

- Closing Remarks: End the letter with a courteous closing, such as “Thank you for your continued business” or “Sincerely.”

- Signature: Include a clear signature and printed name of the sender.

Beyond the Basics: Enhancing Your Statement of Account

By incorporating a letter format, you’ve already set the foundation for a clear and compelling statement of account. Now, let’s explore ways to enhance its effectiveness:

1. Personalize Your Message:

- Targeted Information: Address the recipient’s specific needs or concerns within the letter. For instance, if a payment is overdue, politely but assertively highlight the payment deadline.

- Add Value: Include useful tips or suggestions based on the statement’s content. For example, if a customer’s balance is low, mention loyalty programs or promotional offers.

2. Use Visual Aids:

- Charts and Graphs: For larger companies or complex financial situations, use charts or graphs to illustrate trends and patterns in the account activity.

- Visual Hierarchy: Employ design elements like spacing, bolding, and color to guide the reader’s eye and emphasize key information.

3. Proofread and Review:

- Accuracy: Ensure the accuracy of all data presented, including quantities, dates, and amounts.

- Grammar and Spelling: Carefully proofread the letter to ensure grammatical accuracy and proper spelling.

4. Choose the Right Medium:

- Email: Convenient for sending statements electronically and can include attachments with supplementary information.

- Paper Mail: Maintain a sense of formality and allows for personalization with handwritten notes.

- Online Portals: Offer secure access to statements and allow for easy downloading or printing.

5. Stay Consistent:

- Brand Identity: Adhere to a consistent format and branding throughout all your statements to maintain professional uniformity.

- Template Design: Create a template to streamline the process of creating future statements, ensuring consistency and accuracy.

Image: stepfeed.doralutz.com

Letter Format For Statement Of Account

Unlocking the Power of Clarity: A Call to Action

Crafting a statement of account that is clear, informative, and aesthetically pleasing isn’t just about financial accuracy; it’s about building relationships based on trust and transparency. By adopting a letter format that prioritizes clarity and communication, you’re not just presenting data; you’re fostering understanding and building bridges with your clients and stakeholders.

Ready to take your financial communication to the next level? Start crafting your own clear and engaging statements of account using the letter format guidelines outlined above. This powerful tool will elevate your financial communication, ensuring your information is not only understood but also appreciated.